Burden rates, otherwise known as overhead rates, are used by cost estimators to assign a portion of overhead to estimates. Even to estimators the term is not universally used or applied. Our previous white paper, "Costing System Considerations" deals with some of the difficulties faced when apportioning overhead to an estimate.

A simple yet consistent methodology for the calculation and usage of burden rates is essential for the generation of accurate cost estimates. If you are using our product, eTurboQuote, Excel spreadsheets, or a different system, the proper calculation of application of burden rates is essential. We have developed a simple system and developed an Excel based burden rate calculator.

A good understanding of your cost structure is necessary before you can begin thinking about calculating burden rates. You must work through these five steps:

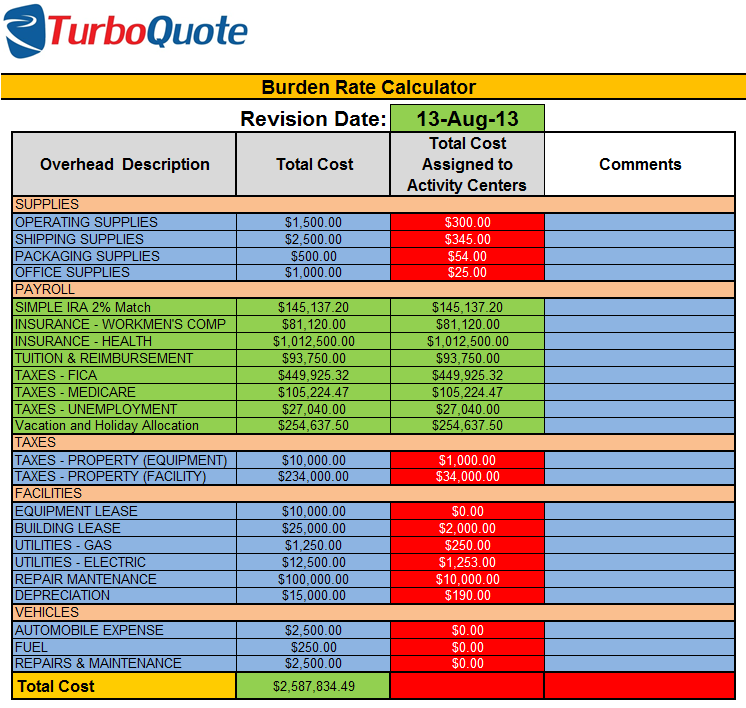

1. Collect and summarize the overhead costs associated with your business. The time period used is up to you, but you must be consistent throughout the analysis. Generally speaking, the maximum time frame should be one year, but we prefer to recalculate burden rates quarterly. Business today changes too rapidly to depend on results that are a year or more old.

In our burden rate calculator the overhead cost summary is found on the Zone 1 – Overhead Summary tab.

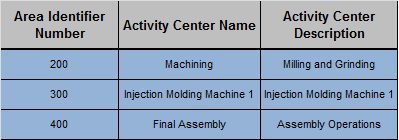

2. Define all of your Activity Cost Centers (Operations, Work Cells, or Machines), and put them on a list

3. Determine the amount of each overhead cost that will be applied against the activity cost center. There are many different approaches to this; for example facility costs are often proportioned by the square footage used.

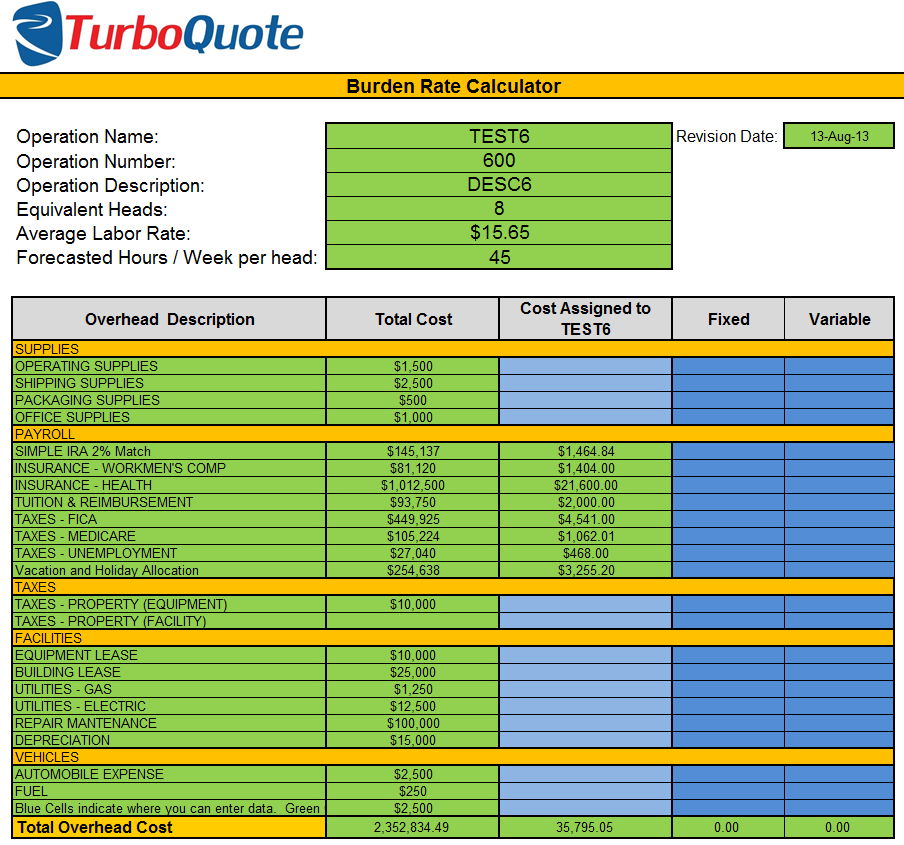

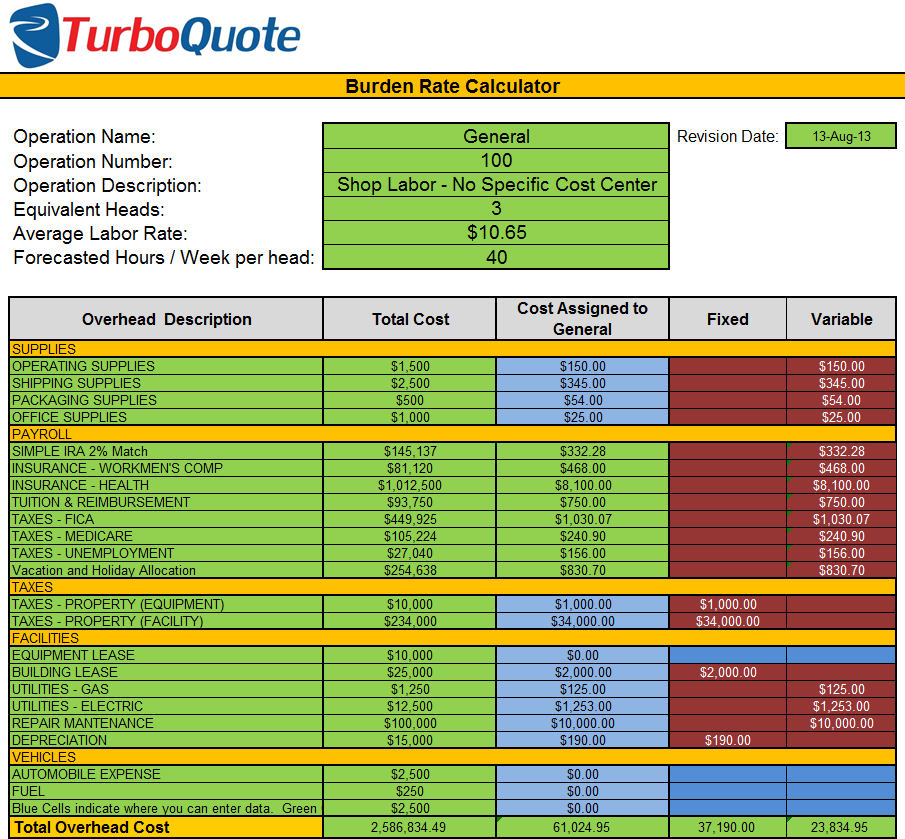

Once it has been decided how to apportion the overhead costs, record the information on a list; one list for each Activity Cost Center. If you are using our calculator, you will find these lists ready to use on the Activity Center 1 – Activity Center 25 tabs.

Often overhead costs are equally distributed across all operations or activity cost centers, but this results in some activity cost centers being over-burdened and others being under-burdened.

4. Once costs are assigned to activity cost centers, you must decide which costs are FIXED and which are VARIABLE. Variable costs are those costs that can be expected to increase in direct proportion to labor hours. Fixed costs are those costs that are mostly independent from hours worked.

If you are using our calculator, you will find these allocation tables, ready to fill-in, on the Activity Center 1 – Activity Center 25 tabs.

5. Finally, calculate the fixed, variable and total overhead rates for each activity cost center.

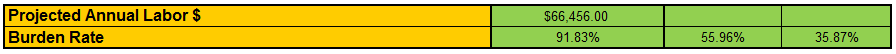

Since overhead rates are generally expressed as a percentage or ratio of direct labor dollars, you will need to develop a solid forecast of labor expenditures for each activity center for the time period specified. This is one of the reasons we prefer quarterly overhead reviews – no one can forecast effectively into the distant future.

Please download our Excel based Burden Rate Calculator to help with this. It is easy to use.

The CEO was sure they were over-allocating their overhead expenses, but they had had expert consultants help them develop the overhead rates, and no one could find anything wrong with the math or the allocations.

When we reviewed the numbers, we also confirmed the math and the allocations were good – but the framework in which it had been developed was flawed. You see, they had combined overhead and SG&A costs, and burdened the manufacturing operations with covering both.

They might have gotten away with it, but a large portion of their sales were of products they purchased and redistributed. The distribution business was bearing none of the selling expense, it was all charged to the manufacturing operations. So it looked like the manufacturing operation was struggling when in fact it was carrying the day.

It is important to keep Overhead expenses distinct from Sales, General and Administrative expenses (SG&A). The difference – overhead expenses are those expenses that are directly related to the manufacture of your product, while SG&A expenses are related to the management of the overall company and the selling and distribution of the product. If you confuse or combine the two, you will generate a distorted cost picture that will make it more difficult to make good decisions.

For precise estimates, the best practice is to assign only the portion of actual overhead costs incurred by an operation or Activity Cost Center.

When multiple processes are used or multiple product families are being produced, usage of overhead resources is far from uniform. For example, a 75 ton injection molding machine will use dramatically less electricity than a 500 ton machine. Differences in depreciation costs of machines and the cost of technical support can be substantial.

When estimating a new project that will require new capital equipment or additional skilled support staff, ABC estimating easily allows the estimator to identify and separate the overall impact and produce realistic estimates.

Businesses routinely evaluate product line profitability. When overhead is spread evenly instead of realistically, the profitability of some product lines are overstated and others understated. This makes it difficult to make high quality decisions.

We strongly recommend using Activity Based Cost estimating (ABC) for all businesses involving multiple processes or products where actual overhead utilization varies from one activity to another. Our cost estimating solution, eTurboQuote, is flexible enough to work with either ABC estimating or traditional estimating, but for accurate results and high quality estimates we always strive to move our clients towards ABC.

ABC costing is superior to traditional cost because it is more accurate. The differences in the costs to operate each Activity Cost Center are identified and accounted for. The likelihood of under-burdening and over-burdening cost centers is virtually eliminated.